In all other cases you can use the cars fair market value. The most important step in deducting the value of your car donation is to insure the charity you donate it to is an IRS tax-exempt organization.

Donating Vehicle For Tax Purposes How To Write Off Your Car Donation Etags Vehicle Registration Title Services Driven By Technology

If your vehicle sells for 100000 at auction and your vacation package that you receive has a fair market value of 40000 you can only deduct 60000.

. Take a look at the example below from our car payment calculator. However with no receipts its your word against theirs. Donation impact based on value average car donation.

Example 3 Sally invests money in some shares. You will need the following statistics to get started. How much did she spend on the shares.

Any calculated value can be shown as a read-only result formatted as currency. The ATO generally says that if you have no receipts at all but you did buy work-related items then you can claim them up to a maximum value of 300. The original car cost 50000.

A car donation tax credit for. Youll still deduct the vehicles FMV at the time of the donation if the charity. However theres one exception.

This could boost your tax refund considerably. You can enter your current loan amount and the current value of your home to determine if you may qualify for a cash-out refinance loan or a non-cashout refinance. Uses it in its charitable efforts.

Get the cars value with every report. Calculator Pros 14 Mile Calculator requires a few sets of data in order to compute your cars quarter-mile elapsed time. Generally these include religious groups charities and organizations that promote education literacy scientific or humanitarian causes.

Cars For a Cure charitable vehicle donation is free and easy. First of all when you select Get Form you get numerous features for efficient document preparing and eSigning. You will see a drop.

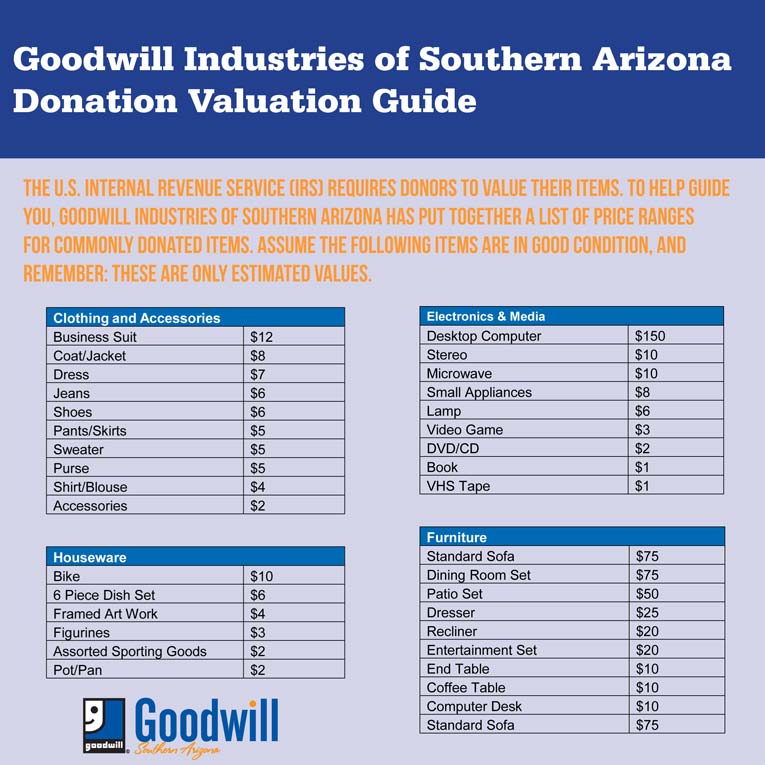

Chances are you are eligible to claim more than 300. The Loan to Value Calculator can also be used to assist with your home refinancing plans. The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items.

You can use calculator 2 to solve this problem. Please choose a value within this range that reflects your items relative age and quality. This list of some common items offers an idea of what your donated clothing and household goods are worth as suggested in the Salvation Armys valuation guide.

Here are 4 simple steps and tips to help you understand and claim a tax deduction for your donated car on your tax return. Makes substantial improvements to the car. To understand the value of your car take it to multiple used.

Thats 100000 for the donated car. Here is how you can get started on finding out the quarter-mile elapsed time of your car. It includes low and high estimates.

Find out how much the charity sold the car for. Save your form and preview it. The ATO says no proof no claim.

Five years later she sells them for 7200 at a profit of 25 of their original value. It must include the amount of cash you donated whether you received anything from the charity in exchange for your donation and an estimate of. If the claimed cars value is 500 or less you can deduct the value of the donated vehicle.

BMI Calculator Videos Quizzes Calculators Healthy Recipes Related Topics. Learn About Carcinogens. Its up to you to assign a value to your item.

Step 1 The percentage of the original number is 100 25 125. Thats why we work hard to. Whether or not you have a trade-in.

The Enterprise Rent-A-Car Foundation donated 30 million to support The Nature Conservancy a global nonprofit that works to address critical conservation challenges around the world. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. The Salvation Army does not set a valuation on your donation.

Only the donations you make to these types of organizations allow you to claim the deduction. To you it might just be a hunk of junk but your charitable car donation could bring hope to cancer patients. Get Your CARFAX Report.

By using our Loan to Value Calculator today you. The value will be updated each time a field that is used in your calculation is changed. Gives it to a needy person.

This initiative is expected to benefit 150 million people by ensuring that healthy rivers across North America and Europe continue to enrich our lives for generations to come. Use the price the charity obtains for selling your car as the amount of your deduction. To set up similar calculations follow the steps below.

The type of license plates requested. While other platforms allow you only to download the Donation Value Guide Spreadsheet for further printing filling and scanning we give you a complete and simple service for preparing it online. The state in which you live.

Next it is possible to select your preferred way to file it without. Each home mortgage lender will have a different loan to value requirement. The exact appraisal amount will change based on local market conditions the dealers inventory and their ability to resell the car.

State the fair market value of that commodity and the fair market value of that commodity must be subtracted from the value of the car donation. Total Weight of Car with the driver included 3. For example if the charity sells the car at auction for.

The county the vehicle is registered in. Fixes up the car and sells it.

Insider Car Buying Tips Trade Sell Or Donate Kelley Blue Book

What Is My Car Donation S Value Tax Deduction

2019 Car Donation Tax Deduction Guide And Faq

2019 Car Donation Tax Deduction Guide And Faq

What Is My Car Donation S Value Tax Deduction

Estimate The Value Of Your Donation Goodwill Industries Of Southern Arizona

How Do I Estimate The Value Of My Donated Car For My Tax Deduction Turbotax Tax Tips Videos